(c)Sabina Lee

Corporate bankruptcy isn’t just numbers on a balance sheet—it’s a story of power,

strategy, and recurring patterns. In “To Protect Their Interests,” Professor Stephen

J. Lubben traces a century-and-a-half of insider control, from 19th-century railroads

to today’s private equity–led restructurings, revealing how the system consistently

favors the powerful while others bear the cost.

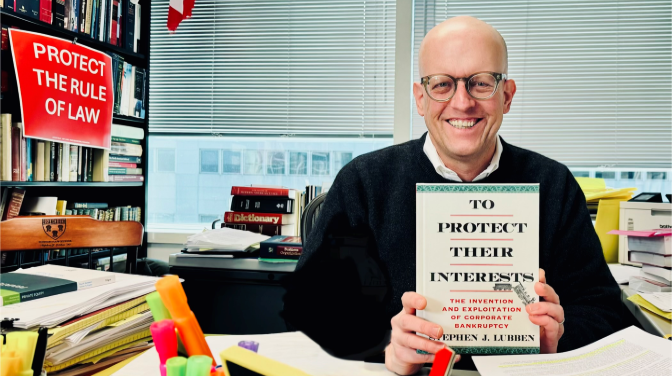

Law Professor Stephen J. Lubben didn’t set out to write a book. His interest began

with a single case—a 1885 receivership of the Texas and Pacific Railroad—that caught

his eye while he was working on an unrelated project. Conventional wisdom held that

corporate bankruptcy didn’t emerge until the 1890s. Yet here was a massive railroad

reorganized years earlier, with insiders maneuvering to protect their control. That

discovery became the seed of Lubben’s sabbatical project—and ultimately, To Protect Their Interests: The Invention and Exploitation of Corporate Bankruptcy.

“I realized I could write a revised history of American corporate bankruptcy,” Lubben recalls. He spent months in the National Archives, poring over old filings, court records, and reorganization plans. What emerged was a through line connecting 19th-century railroad tycoons like Jay Gould to today’s private equity firms—different eras, same playbook.

“The insiders use the bankruptcy process to gain control of big corporations,” he explains. “Just like Jay Gould did in the 1880s, private equity firms are doing it today.” From Neiman Marcus to J.Crew, the playbook is familiar: heavy debt loads, orchestrated filings, and insider protections. Meanwhile, employees, small vendors, and local communities bear the brunt.

Modern corporate bankruptcy has become a high-stakes game. Companies plan Chapter 11 filings down to the smallest operational detail, ensuring planes keep flying or stores remain open. Private equity firms strategically layer debt, maximizing their returns if the company thrives—and shifting losses to others if it doesn’t. “Once you see how it works,” Lubben says, “it’s clear that Chapter 11 is no longer just a legal safety net; it’s a tool for insiders.”

The winners are often the professionals running the system. Lawyers billing thousands

per hour generate millions for themselves, while the public absorbs the ripple effects.

Lay employees may lose their jobs, local suppliers go unpaid, and communities watch

anchor stores shutter, leaving vacant malls and struggling neighborhoods.

The winners are often the professionals running the system. Lawyers billing thousands

per hour generate millions for themselves, while the public absorbs the ripple effects.

Lay employees may lose their jobs, local suppliers go unpaid, and communities watch

anchor stores shutter, leaving vacant malls and struggling neighborhoods.

History shows this pattern is far from new. Even in the 1860s and 1870s, bankruptcy played out much like it does today, with insiders navigating the system to their advantage. Lubben’s research traces this continuity from early railroads through the Missouri Pacific Reorganization, a 23-year bankruptcy spanning the Great Depression and World War II, to the recent Purdue Pharma opioid litigation. In each case, insiders protected themselves, while outsiders bore costs—and reform remained elusive.

“Bankruptcy has always been dominated by sophisticated players,” Lubben notes. “No matter how the rules change, the system favors those who understand it—and engage with it repeatedly.” Political pressure or reform is rare, often requiring sympathetic victims and high-profile scandals to spur action. Even recent private equity–owned hospital bankruptcies have failed to draw significant legislative attention.

Lubben’s book, published by Columbia University Press, blends historical scholarship with contemporary insight. It illuminates the forces shaping modern corporate finance, showing how the rules, while evolving, have consistently benefited insiders over the past century. For anyone seeking to understand today’s bankruptcies—from collapsing retail giants to leveraged buyouts—the book offers a revealing lens into a system long controlled by those who know it best.

By tracing the arc from railroads to retail, Lubben demonstrates that bankruptcy is

not merely a legal mechanism; it is a mirror of American capitalism itself—its promises,

its failures, and the subtle ways power and strategy shape outcomes across generations.

Stephen J. Lubben is an internationally recognized expert in the field of corporate finance and governance,

corporate restructuring, financial distress and debt. Professor Lubben's most recent

book – To Protect Their Interests: The Invention and Exploitation of Corporate Bankruptcy – was published by Columbia University Press in 2026. He is also the author of a

leading corporate finance text, currently in its 4th edition. From 2010 to 2017 he

authored the In Debt column for the New York Times' Dealbook page.

Stephen J. Lubben is an internationally recognized expert in the field of corporate finance and governance,

corporate restructuring, financial distress and debt. Professor Lubben's most recent

book – To Protect Their Interests: The Invention and Exploitation of Corporate Bankruptcy – was published by Columbia University Press in 2026. He is also the author of a

leading corporate finance text, currently in its 4th edition. From 2010 to 2017 he

authored the In Debt column for the New York Times' Dealbook page.

For more information, please contact:

Office of Communications and Marketing

(973) 642-8714

[email protected]