Online LL.M. Degree in Corporate Compliance

Enrollment Services

[email protected] | 973-642-8502 or 973-761-9000 ext. 8502

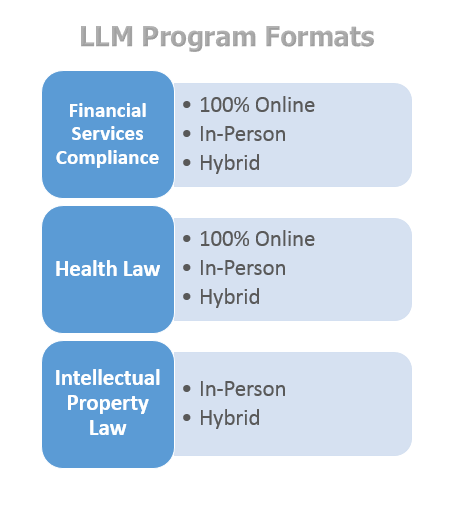

The increase in federal laws and regulations governing all types of businesses and the focus of enforcement placed on companies' compliance efforts creates opportunities for attorneys with demonstrated expertise in law and compliance. Seton Hall Law School now provides training beyond the J.D. degree to select students, practitioners and scholars in the growing and increasingly complex area of corporate compliance. Interested students may pursue an entirely online LL.M. degree option or a hybrid option with the opportunity to come to campus for in-person instruction.

ADMISSION

A candidate seeking admission to the LL.M. program must have a J.D. degree from a law school that is approved by the Section of Legal Education of the American Bar Association or the foreign equivalent from a school of law. The Admissions Committee considers practice experience, graduate degrees in the financial field, quality of law school academic record, demonstrated interest in compliance, and evidenced ability to excel in academic pursuits. The application process is rolling and applications for admission are accepted at any time.

APPLICATION REQUIREMENTS

COURSE OF STUDY

LL.M. candidates must meet the following requirements:

- Completion of 24 credit hours of course work at the Law School;

- Completion of a high quality paper, under the supervision of a full-time faculty member; and

- Maintenance of a GPA of at least 3.0.

COURSE OFFERINGS

Required Courses | 4 credits

| Number | Name | Credit | Offering |

|---|---|---|---|

|

CORP7144 |

Governance, Compliance, Enforcement and Risk Management

This course explores corporate governance metrics for complying with federal and state regulatory frameworks, including internal corporate compliance protocols used to fulfill the company’s mission and to minimize risk in the management of the corporation. Topics covered include:

|

2 |

online |

|

CORP7160 |

Global Corruption: Regulation, Compliance, and Enforcement

This course introduces students to the theory and practice of global anti-corruption compliance. Topics covered include the definition, identification and measurement of corruption; the OECD Convention on Combatting Bribery of Foreign Public Officials; the U.S. Foreign Corrupt Practices Act; the UK Bribery Act; anti-corruption laws in other countries; investigation, enforcement and resolution of corruption activities; jurisdiction, corporate liability and individual responsibility; and anti-corruption compliance programs and international organizational responses.

|

2 |

online |

Advanced Writing Requirement | 2 or 3 Credits

In-person LL.M. students shall satisfy their advanced writing requirement in an 3-credit AWR seminar taught by a full-time faculty member. The full-time faculty member teaching the AWR seminar shall serve as the LL.M. student's supervisor. The final paper must satisfy the law school's advanced writing requirement.

Online LL.M. students shall satisfy their advanced writing requirement in a 2-credit graded writing mentorship, under the supervision of one or more faculty members. During the mentorship, students will conduct advanced research on one or two topics relevant to the student's degree program and produce one or two written papers that satisfy the law school's advanced writing requirement. Students must register for the writing mentorship no later than six months prior to their expected date of graduation.

Electives | 17-18 Credits

* Students may take up to 2 elective courses from another concentration area in place

of courses on this list.

| Number | Name | Credit | Offering |

|---|---|---|---|

|

CORP7130 |

Accounting for Lawyers

This course surveys elementary techniques and basic theoretical concepts of accounting

for law students with little or no accounting background. It provides an introduction

to: accounting statements and statement analysis; the accounting cycle; fixed asset

accounting and depreciation; and corporate and estate accounting. |

2 |

in-class |

|

CORP8133 |

Business Planning

This course analyzes basic issues to be considered in the organization, operation and disposition of business ventures, combining concepts of partnership, limited liability company and corporate law, finance, securities law and taxation. The course will focus on four primary areas: formation and capitalization of the enterprise, determining participation in profit and loss, rewarding employees and service providers and exit strategies, including business combinations and taxable and tax-free dispositions.In addition to traditional teaching methods, the course involves guest lectures from entrepreneurs, investors and others involved in the field. Significant emphasis will be placed on federal and state tax issues affecting business planning decisions. Fundamental principles of entity-level and pass-through taxation will be discussed. |

3 |

in-class |

|

LABR7030 |

Conducting Internal Investigations

This course gives you the tools you need to participate in all aspects of internal workplace investigations. Topics covered include:

|

2 |

online |

|

INDL7550 |

Cybersecurity and Privacy I: Law & Policy

This course provides a broad overview of key issues at the intersection of cybersecurity and privacy. Topics covered include:

|

2 |

online |

|

INDL7555 |

Cybersecurity and Privacy II: Compliance and Risk Management

This course describes practical frameworks for data privacy and security risk management and compliance. We examine the CIA (Confidentiality, Integrity, and Availability) Triad, the NIST Cybersecurity and Privacy Frameworks, and essential principles of Privacy by Design (PbD), along with qualitative and quantitative methods of cyber risk assessment. We apply these frameworks and methods to realistic cybersecurity and privacy scenarios. We further explore methods of transferring cyber risk, including third-party contract terms and cyber insurance. Finally, we discuss legal requirements relating to data breach response and other forms of legal process concerning digital information. Prerequisite: INDL7550 Cybersecurity I |

2 |

online |

|

INDL8340 |

Cybersecurity: Computer Crimes and Personal Security

This module evaluates the nature of cyber crime and the legal framework for fighting cyber crime. We will learn about common modes of cyber attack, the use of mass crime tools such as "botnets," and the role of organized crime in cyberspace. We will study the U.S. Computer Fraud and Abuse Act and related U.S. and international laws that apply to computer crimes. We will also consider threats to personal safety arising out of cyberspace, including bullying, stalking, harassment, and child pornography, and we will study the unique legal challenges involved in crafting statutes to address such conduct without unduly impinging on rights of free speech and free association. |

1 |

in-class |

|

INDL8341 |

Cybersecurity: National Security, Surveillance, and Cyber-War

This module considers the problem of cyber-terrorism, cyber-espionage, and cyber-war. The U.S. military now considers "cyber" a "fifth domain" of warfare, after land, sea, air, and space. We will consider how the laws of war and emergencies relate to cyber incidents. We will also discuss the nature of Internet surveillance of private citizens, through an in-depth review of cases and materials relating to the Federal Intelligence Surveillance Act (FISA) Court. |

1 |

in-class |

|

CORP7180 |

EU Data Protection and Privacy Law: The GDPR

This course introduces students to the legal regime governing information privacy, data protection, and data security in the European Union. Topics covered include data protection and privacy in the European Court of Human Rights, the Data Protection Directive and the General Data Protection Regulation (GDPR), data protection supervisory authorities and international data transfers, the "right to be forgotten," and cybersecurity in Europe. |

2 |

online |

|

INDL8342 |

Evidence, Cyber-Compliance and Cyber-Investigations

This is a skills-based module centered on the role of the lawyer or compliance officer in mitigating an organization's cyber-risks, conducting forensic investigations in the event of data breaches or other cyber incidents, and presenting evidence in court or in other legal proceedings regarding the nature and causes of a cyber incident. Students will engage in a variety of hands-on skills exercises, such as a simulated "table top" cyber-risk assessment. |

2 |

in-class |

|

CRJU7404 |

Federal Criminal Law

This course provides an in-depth study of corporate and white-collar crimes, including: RICO; mail fraud; federal drug offenses; criminal tax enforcement; bank secrecy statutes; false statements to law enforcement agents; criminal civil rights statutes; obstruction of justice; Hobbs Act; Mann Act; securities fraud; environmental crimes; workplace death and injury; and choice between federal and state prosecutions. |

3 |

in-class |

|

CORP8160 |

Financial Crimes Compliance

This course introduces students to the theory and practice related to financial crimes compliance in the United States, and at the global level. Particular laws examined include: the Money Laundering Control Act, the Bank Secrecy Act, and associated regulations. At the international level, the course also outlines the work of the Financial Action Task Force and its recommendations on combatting money laundering and terrorism financing. |

2 |

online |

|

CORP7185 |

Financial Privacy Law

This course explores the federal, state and judicial scheme designed to protect the privacy and security of financial information. Topics covered include:

|

|

|

|

CORP7140 |

Introduction to Corporate Law

This corporate law course examines the organization and operation of business enterprises, with particular emphasis on the corporate form. Topics covered include:

|

2 |

online |

|

CORP9130 |

Issues in Corporate Governance and Securities Regulation

This course examines federal and state regulations of securities, including disclosure requirements, rules governing public and private offerings, and remedies and liabilities. The course also explores within the context of securities regulations current topics relating to the tensions between the interests of issuers and shareholders. This course will highlight challenges raised in the context of corporate governance. Issues to be discussed include fiduciary duties of directors and controlling shareholders; rights of shareholders; use of proxy machinery; and liability for insider trading, including an analysis of SEC Rule 10b-5. |

3 |

in-class |

|

LABR7000 |

Managing Legal Issues in the Workplace

This course explores the core doctrines that govern the employment relationship. Topics covered include:

|

2 |

online |

ACADEMIC STANDING

LL.M. students must remain in good academic standing throughout the program. View the full academic policy.

EXAM PROCEDURES

Each student is given an exam number. In addition to using his or her exam number, each student should indicate on the front of his/her exam that he/she is an LL.M. candidate. This allows professors to exclude graduate students from the mandatory J.D. grading curve. No other reference to identity should be indicated on the exam. Every effort to maintain a student’s anonymity will be made; however, anonymity may sometimes be compromised due to the small number of graduate students enrolled in a given class.

How to Apply or Request Additional Information About the Seton Hall Law LL.M. Program.

For additional information, please contact

Enrollment Services

[email protected]

973-642-8747

or request information online.